9 Helpful Payroll Tips For Small Businesses

Try When I Work for free

Small business owners face a lot of challenges when it comes to payroll. From having to keep up with ever-changing compliance laws to simply finding the time to calculate wages, taxes, and overtime, the payroll process can easily become overwhelming.

It’s important for small business owners to know that many in their shoes face the same frustrations. Fortunately, there are solutions that can help reduce the burden. Check out these payroll tips for small businesses.

Even if you don’t have a full-time HR team, you can streamline the payroll process. Discover how technology and organization can help you make payroll more efficient, so you can stop spending so much time on HR tasks and take your business to the next level.

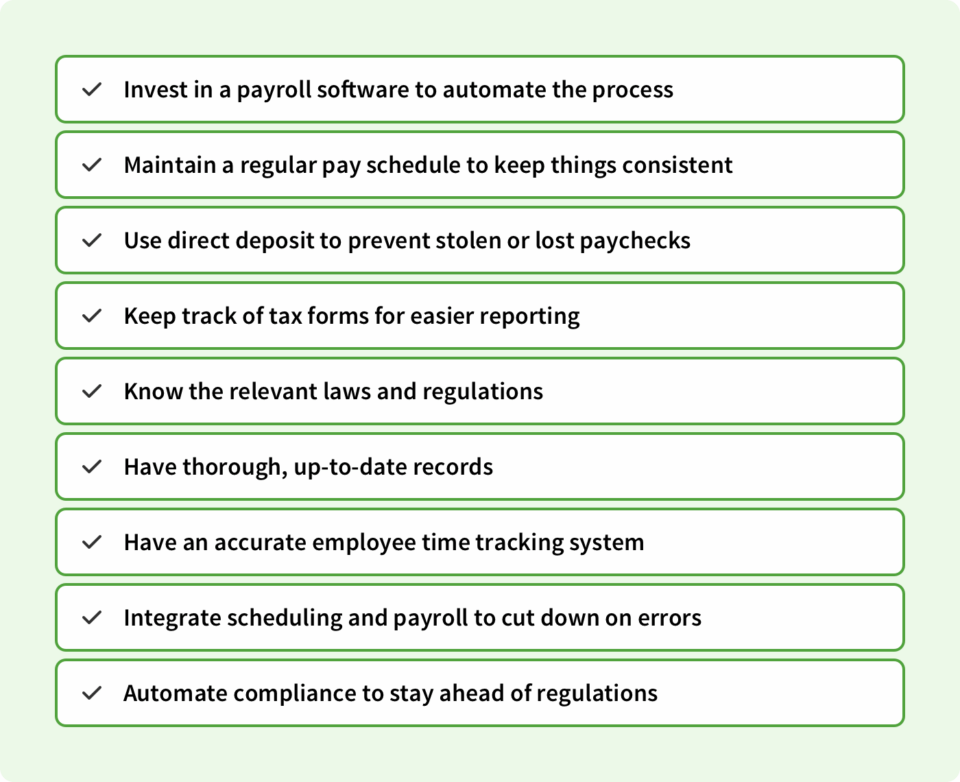

Key takeaways

- The key to efficient payroll is automation

- Keeping up with changing laws and regulations keeps your business safe

- Organization leads to small business payroll success

- Thorough recordkeeping can defend against legal challenges

- Good payroll processes start with streamlined scheduling and timekeeping

Table of contents

- What’s the most common payroll challenge for small businesses?

- 9 payroll tips for small businesses

- 1. Invest in a payroll software to automate the process

- 2. Maintain a regular pay schedule to keep things consistent

- 3. Use direct deposit to prevent stolen or lost paychecks

- 4. Keep track of tax forms for easier reporting

- 5. Know the relevant laws and regulations

- 6. Have thorough, up-to-date records

- 7. Have an accurate employee time tracking system

- 8. Integrate scheduling and payroll to cut down on errors

- 9. Automate compliance to stay ahead of regulations

- Why better payroll leads to smoother business operations

- FAQs: Payroll tips for small businesses

What’s the most common payroll challenge for small businesses?

In today’s world, remote and hybrid work is on the rise. With nearly 20% of all workers now working from home at least a few days a week, many experts believe the hybrid work model is here to stay.

While this is great news for employees and contractors, it can present a serious challenge for small business owners. The hybrid work model means you may be employing workers across multiple states.

Even if you’re a multi-location business with employees working in person, having workers in different places means keeping up with state and local compliance laws and regulations. This is challenging if you’ve never done business in those jurisdictions before.

Still, you can’t ignore these laws, as doing so can result in large fines, penalties, and even lawsuits. Finding a solution to this and similar issues is paramount to keep your business out of harm’s way without overwhelming yourself.

9 payroll tips for small businesses

Small business payroll can feel daunting for business owners, especially if you don’t have a full-time HR staff to take care of it for you. Here are several ways to improve payroll management and make the process easier for yourself.

1 Invest in a payroll software to automate the process

Small business owners have a lot on their plates. Calculating accurate wages for employees with multiple employment types and locations, filing payroll taxes, and staying in compliance with federal, state, and local regulations are just a few examples of required tasks.

Doing all of this manually increases the risk of human error. This, in turn, increases the likelihood of compliance issues. Additionally, it increases the administrative burden. Of all the HR activities to be done, 27% of payroll staff report spending the most time running payroll.

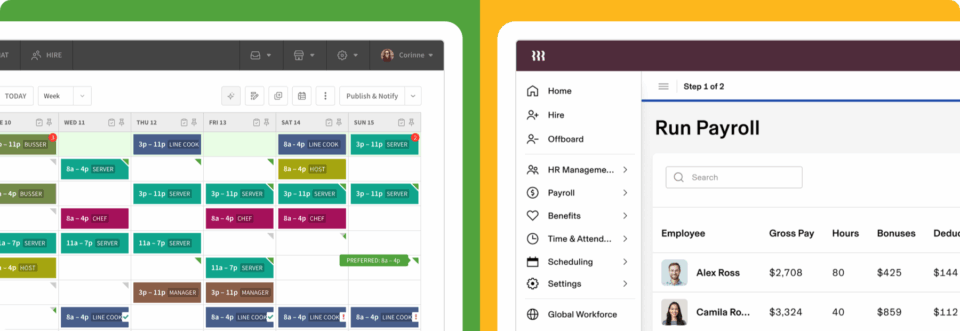

Automating payroll tasks like reconciling timesheets, making calculations, and processing pay saves time and reduces errors. Platforms like When I Work integrate scheduling, time tracking, and payroll in one place. And with providers like Rippling, our preferred payroll and compliance partner, you can also streamline benefits, taxes, and compliance.

2 Maintain a regular pay schedule to keep things consistent

There are no federal laws stating you have to pay your employees on a certain schedule. However, most state laws say you must pay them consistently and within a reasonable amount of time after they complete the work. Some states, like Texas, go as far as to say that semi-monthly pay periods must contain a near-equal number of days.

Keeping a consistent pay schedule is the law. It’s also just good business. Getting into a routine with payroll can help lower your stress levels and reduce your chances of forgetting to run it. A regular pay schedule also helps you maintain good relationships with your employees, who will appreciate being able to count on consistent paychecks.

3 Use direct deposit to prevent stolen or lost paychecks

According to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN), check theft and fraud have seen a sharp incline. Both have nearly doubled since 2021, and this pattern shows no signs of slowing down. As an employer, you may believe that there’s nothing you can do to help your employees avoid this, but that’s not true.

Using direct deposit is one way to help keep your employees safe. With direct deposit, their earned wages go directly into their bank accounts, so there are no paper checks to steal. Furthermore, your employees get immediate access to their funds in most cases since they won’t have to wait for the check to clear.

4 Keep track of tax forms for easier reporting

Federal law requires you to not only file and pay taxes but also report your payroll information to the IRS. This includes details about wages, tips, and any other form of compensation you pay out to your employees.

Some tax forms, like Form 941, require you to report on your quarterly taxes. Others, like Form 944, may require you to report information annually. There are other forms you must use if you’ve paid farmworkers or made non-payroll payments.

You can make reporting easier for yourself by keeping track of these tax forms. You might do that in your accounting software or simply file them away in a folder on your computer’s desktop. Either way, keeping them organized can reduce your stress levels—you won’t have to hunt them down when it’s time to file.

5 Know the relevant laws and regulations

Every industry has compliance laws and regulations. The Fair Labor Standards Act is a federal law that applies to most businesses and employees and governs minimum wage, recordkeeping, and overtime pay. FICA (the Federal Insurance Contributions Act) governs Medicare and Social Security tax withholding.

Still, every state and local jurisdiction has laws you must follow concerning payroll taxes, pay frequency, and even payment methods. Violations can result in costly fines, penalties, and lawsuits, which are a big deal to a small business.

Do what you can to protect yourself by using payroll software that automatically stays updated with relevant laws and regulations. This is especially critical if you employ workers across multiple states or manage hybrid teams. Tools like When I Work combined with Rippling’s compliance features help small businesses avoid costly mistakes.

6 Have thorough, up-to-date records

Payroll recordkeeping is more than just a good idea—it’s the law. The IRS requires all businesses to keep records of employment taxes for at least four years. The FLSA requires you to keep time clock and other records for two or more years. Other types of records may need to be kept for longer.

Keeping updated records helps you find the paperwork you need in case you are ever audited. It also protects you in the event that a current or former employee files a complaint or lawsuit against you. With good recordkeeping, you’ll have proof that you’ve followed all employment laws.

7 Have an accurate employee time tracking system

One of the best payroll tips for small businesses is to start with employee scheduling and time tracking. When you track time accurately, you won’t have to worry about whether you’re paying employees the correct amount, withholding the right amount, or unintentionally missing overtime pay they may be owed.

A good time-tracking system gives you peace of mind that you are following the law and handling your payroll process with integrity and consistency.

8 Integrate scheduling and payroll to cut down on errors

One of the most overlooked payroll tips for small businesses is to connect your scheduling and payroll systems. When hours worked sync directly with payroll, you eliminate double entry, manual errors, and ensure employees are paid accurately for every shift.

9 Automate compliance to stay ahead of regulations

Payroll isn’t just about paying employees—it’s about staying compliant. Automating compliance features helps you manage tax filings, wage rules, and benefit deductions without stress. With Rippling as the preferred compliance partner of When I Work, you’ll have the peace of mind that your payroll is always up to date.

Why better payroll leads to smoother business operations

Small business payroll is a complex process. Many business owners face challenges with paying a global workforce, maintaining legal compliance, and overworking themselves with manual payroll methods. Fortunately, When I Work makes payroll easier with built-in scheduling, time tracking, and payroll integrations. Plus, our preferred partnership with Rippling expands your options for payroll, compliance, and HR so you can grow with confidence.

Payroll doesn’t have to drain your time or cause unnecessary stress. By automating tasks, integrating scheduling and payroll, and staying on top of compliance, you can transform payroll into a streamlined process. With When I Work—and partnerships with providers like Rippling—you’ll have the tools to simplify payroll, boost accuracy, and keep your employees happy. Sign up for a free trial today.

If you’re already a When I Work customer, you can get 6 FREE months of Rippling payroll and everything else they have to offer. Find out more!

FAQs: Payroll tips for small businesses

What’s the best way to do payroll for a small business?

The best approach is to use payroll software that integrates with scheduling and time tracking. This ensures accuracy, saves time, and helps you stay compliant.

How much does it cost to run payroll for a small business?

Costs vary, but most payroll providers typically charge a per-employee monthly fee. Using an integrated solution like When I Work and Rippling can reduce overhead by combining payroll, scheduling, and compliance in a system that works well together.

What is the most significant payroll challenge for small businesses?

Compliance with state and federal laws is the top challenge. Automated payroll tools simplify recordkeeping, tax filings, and wage calculations to give you peace of mind.

How can small businesses reduce payroll errors?

Accurate time tracking, integrated scheduling, and automated payroll software help reduce errors by eliminating manual entry, so you can be sure that your employees are paid correctly and on time every pay cycle.